An increasingly popular method people are using to purchase homes is called House Hacking. House hacking is a real estate investing strategy where an individual purchases a property with the intention of living in one part of the property while renting out the remaining units or rooms to generate income and offset their living expenses.

The house hacking idea is that the rental income generated by the property will cover some or all of the mortgage, property taxes, insurance, and other expenses, allowing the owner to live in the property for free or at a reduced cost. House hacking is often used as a way for individuals to enter the real estate investing world, build equity, and generate passive income. House hacking offers some great benefits but also has a few drawbacks. Read on to learn more.

Advantages to House Hacking

Reduced Living Expenses

One of the biggest advantages of house hacking is that it can significantly reduce living expenses. By renting out a portion of the property, the owner can generate income that can be used to offset their mortgage, property taxes, insurance, and other expenses, potentially allowing them to live in the property for free or at a reduced cost.

Income Generation

House hacking can also provide a source of passive income for the owner. The rental income generated from the property can be used to build wealth, pay down debt, or reinvest in additional properties.

Equity Building

Over time, as the property increases in value and the mortgage is paid down, the owner will build equity in the property. This equity can be used to finance additional real estate investments or other financial goals.

Property Management Experience

House hacking provides an opportunity for the owner to gain experience in property management, including tenant screening, lease agreements, maintenance and repairs, and financial management.

Qualify for a Larger Mortgage

One of the biggest advantages is that house hacking can help you qualify for a larger mortgage than you might be able to otherwise. This is because lenders may take into account the rental income you’ll be earning from the property when determining your ability to repay the mortgage.

Pay Down the Mortgage Faster

Another benefit of house hacking is that you may be able to use the rental income to pay down your mortgage faster. By applying the rental income to your mortgage payments, you can reduce the principal balance of your loan and build equity in the property more quickly.

House Hacking Disadvantages

Lack of Privacy

When living in a property that is also being rented out, there may be a lack of privacy. You may have to share common areas, such as a backyard or laundry room, with tenants, which can be an issue for some homeowners.

Landlord Responsibilities

As a landlord, you’ll be responsible for managing the property and handling tenant issues, such as repairs and maintenance, rent collection, and tenant screening. This can be time-consuming and may require additional expenses, such as hiring a property management company.

Tenant Turnover

When renting out part of a property, there may be more tenant turnover than in a traditional rental property. This can create additional work for the landlord in terms of finding new tenants, conducting move-in/move-out inspections, and completing lease agreements.

Market Fluctuations

Real estate markets can be unpredictable and subject to fluctuations. If the market experiences a downturn, rental rates and property values may decrease, which could negatively impact your investment.

Regulatory Issues

Depending on where you live, there may be regulatory issues to consider when house hacking, such as zoning laws, building codes, and landlord-tenant laws. It’s important to research and comply with all relevant regulations to avoid any legal issues.

Things to Consider before House Hacking

- Research the market: Before buying a property, it’s important to research the real estate market in the area you’re interested in. Look at comparable sales and rental rates to determine whether a property is a good investment opportunity.

- Determine your budget: House hacking can be a great way to reduce living expenses, but it’s important to determine your budget before buying a property. Calculate your monthly expenses, including mortgage payments, property taxes, insurance, and maintenance costs, and ensure that you have enough income to cover these expenses.

- Identify the right property: When looking for a property to house hack, consider factors such as location, property type, and potential rental income. Look for properties that have separate living spaces or units that can be rented out, and consider the potential rental income from each unit.

- Screen potential tenants: When renting out part of your property, it’s important to screen potential tenants carefully. Look for tenants with a stable income, good credit history, and positive rental references.

- Develop a plan: Before buying a property, develop a house hacking plan that outlines your goals, budget, and strategies for managing the property. Consider factors such as lease agreements, maintenance and repairs, and financial management.

All in all house hacking might be a great way to get into a property at a lower cost to you. In this day and age with high interest rates and high property values this could be a great way into the real estate market!

The Landing at Greens Mill (Columbia TN off of Greens Mill Rd)

Welcome to The Landing at Greens Mill Rd. This neighborhood is located on the north side of Maury County off of Greens Mill Rd. It has east access to the unincorporated town of Neapolis as well as quick travel to Spring Hill (6 minutes) or…

1000 Peyton Place Columbia, TN 38401 – The Estates at Prince Farms

Welcome to 1000 Peyton Place Columbia, TN! This home greets you as you enter The Estates at Prince Farms. The Estates at Prince Farms, when completed, has 28 total homes all on 1 acre lots. All homes in the development are being constructed by the…

Advice for 1st Time Home Buyers in Tennessee

When buying a home for the first time it’s very easy to get wrapped up in all the excitement of looking at houses. You see the photos online, dream of your new home, and all the things you can do in the place. It’s exciting!…

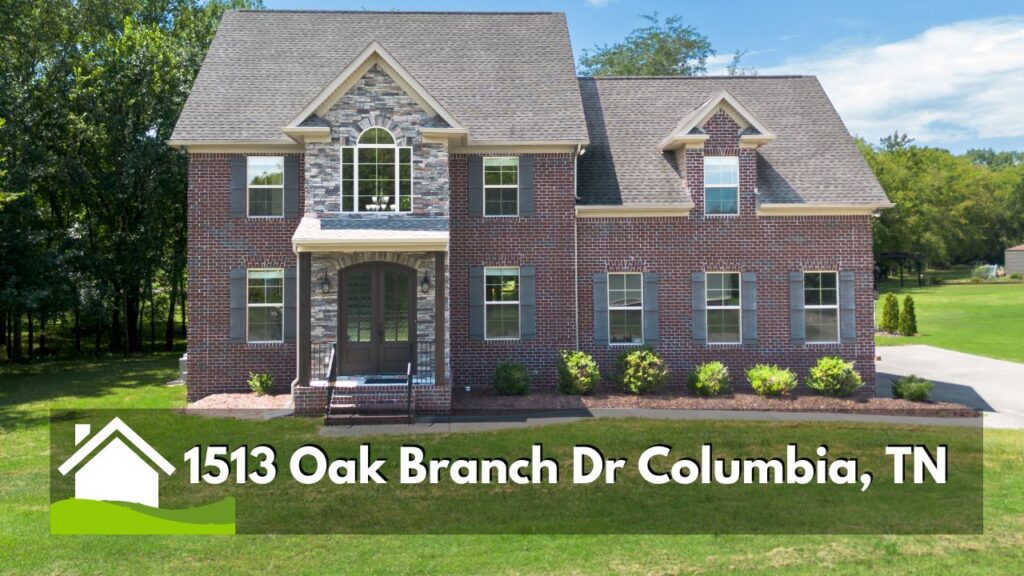

1513 Oak Branch Dr Columbia, TN – Home on an Acre NO HOA!

Are you looking for an ALL Brick home on an acre lot? In a neighborhood without an HOA? A place convenient to Spring Hill, TN and easy access to commuting to Franklin TN? Then check out 1513 Oak Branch Dr in Columbia TN! This location…

5059 Kedron Rd Columbia, TN – Land and Shop for Sale

The sellers removed this property from the market. If you are interested in this property or similar one’s please contact me. What if you could find land in an amazing location, convenient to everything, but not too close to everything? Land that already has the…

Bluebird Hollow – Spring Hill, TN

Bluebird Hollow in Spring Hill, TN is located just off of Main Street through the Autumn Ridge subdivision. You can also get access to this little tucked away neighborhood through Depot St. Bluebird Hollow homes feature Brick and stone exterior with nice interior finishes. Homes…