USDA loans are a type of mortgage that is guaranteed by the United States Department of Agriculture (USDA). They are and are designed to help low- and moderate-income borrowers in rural areas purchase a home. The USDA loan program is also known as the USDA Rural Development Guaranteed Housing Loan Program.

Types of USDA Loans

There are several types of USDA loans, including:

- Single Family Housing Guaranteed Loan Program: This program is designed to help eligible borrowers with low or moderate incomes purchase homes in eligible rural areas. The loans are guaranteed by the USDA and allow for up to 100% financing.

- Single Family Housing Direct Home Loans: These loans are also designed to help low-income borrowers purchase homes in eligible rural areas, but they are made directly by the USDA. These loans may also provide up to 100% financing.

- Home Improvement Loans and Grants: This program provides loans and grants to eligible homeowners in rural areas to make repairs or improvements to their homes.

To be eligible for a USDA loan, the borrower must meet certain income and credit requirements and the property being purchased must be located in an eligible rural area as defined by the USDA. The borrower must also intend to use the property as their primary residence.

USDA Loan Requirements

To be eligible for a USDA loan, the borrower must meet certain requirements. Here are some of the key requirements:

- Income requirements: The borrower’s household income cannot exceed the area median income (AMI) for the county where the property is located. The exact income limit varies depending on the county and the number of people in the household.

- Credit requirements: The borrower must have a credit score of at least 640, although some lenders may require a higher score. The borrower must also have a history of on-time payments and no recent bankruptcies or foreclosures.

- Property requirements: The property being purchased must be located in an eligible rural area, as defined by the USDA. The property must also be a single-family, owner-occupied residence, and it must meet certain minimum property standards to ensure that it is safe and habitable.

- Employment and residency requirements: The borrower must have a stable income and employment history, and they must intend to use the property as their primary residence.

- Debt-to-income ratio: The borrower’s debt-to-income ratio (DTI) must be no higher than 41%. This means that the borrower’s monthly debt payments (including the mortgage payment) cannot exceed 41% of their monthly income.

It’s important to note that these are just general requirements and that specific lenders may have their own additional requirements. Additionally, the USDA loan program has different requirements and restrictions for its different loan types. It’s important to consult with a lender who is experienced with USDA loans to determine if you are eligible and what specific requirements you need to meet.

The Landing at Greens Mill (Columbia TN off of Greens Mill Rd)

Welcome to The Landing at Greens Mill Rd. This neighborhood is located on the north side of Maury County off of Greens Mill Rd. It has east access to the unincorporated town of Neapolis as well as quick travel to Spring Hill (6 minutes) or…

1000 Peyton Place Columbia, TN 38401 – The Estates at Prince Farms

Welcome to 1000 Peyton Place Columbia, TN! This home greets you as you enter The Estates at Prince Farms. The Estates at Prince Farms, when completed, has 28 total homes all on 1 acre lots. All homes in the development are being constructed by the…

Advice for 1st Time Home Buyers in Tennessee

When buying a home for the first time it’s very easy to get wrapped up in all the excitement of looking at houses. You see the photos online, dream of your new home, and all the things you can do in the place. It’s exciting!…

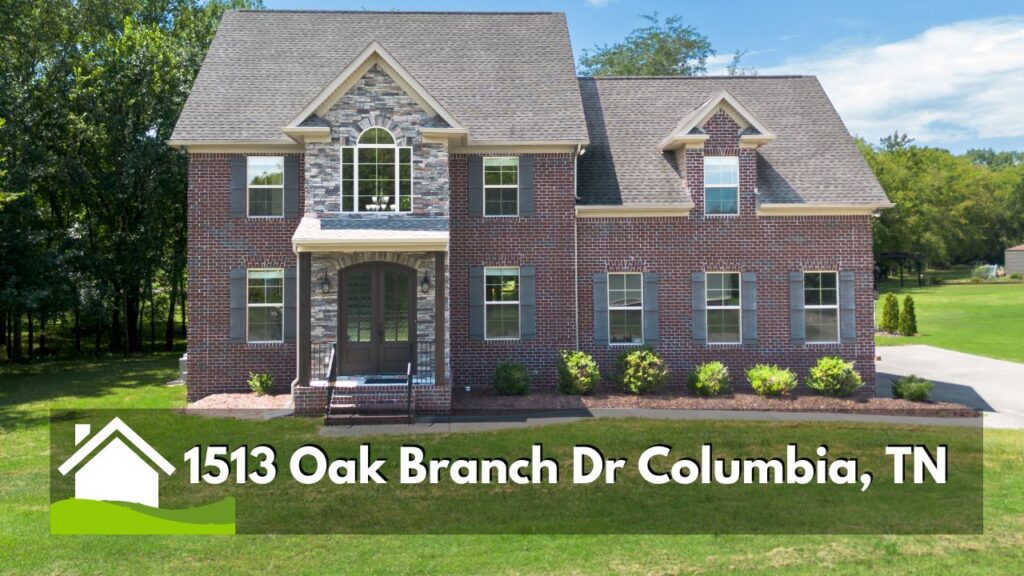

1513 Oak Branch Dr Columbia, TN – Home on an Acre NO HOA!

Are you looking for an ALL Brick home on an acre lot? In a neighborhood without an HOA? A place convenient to Spring Hill, TN and easy access to commuting to Franklin TN? Then check out 1513 Oak Branch Dr in Columbia TN! This location…

5059 Kedron Rd Columbia, TN – Land and Shop for Sale

The sellers removed this property from the market. If you are interested in this property or similar one’s please contact me. What if you could find land in an amazing location, convenient to everything, but not too close to everything? Land that already has the…

Bluebird Hollow – Spring Hill, TN

Bluebird Hollow in Spring Hill, TN is located just off of Main Street through the Autumn Ridge subdivision. You can also get access to this little tucked away neighborhood through Depot St. Bluebird Hollow homes feature Brick and stone exterior with nice interior finishes. Homes…