It is very unusual to find a contract for property that doesn’t have some sort of contingency, but what does contingent really mean when it comes to real estate? A contingency is a clause in a real estate contract that gives the buyer a way out of the contract without any penalty. There are quite a few common types of continencies like home sale contingencies, financing continencies, a home inspection contingencies, appraisal contingencies, and several that are less common. In fact if you can think of a reason to make a contingency you could make one up although I would recommend sticking with the standard types!

When you have a contingency in a contract it sets certain parameters and if those happen it sets up another option. Think of a contingency as an “if, then” statement with computer coding. If “the buyer cannot get approved for financing” then “the contract is considered terminated and they are entitled to a full refund of their earnest money.” That’s normally how they work. The standard contingencies are very straight forward.

Home Sale Contingency

A home sale contingency is not a contingency that seller’s usually love to see. It happens when a buyer has a home to sell and can’t buy the next home without selling the one they have first. If the buyer can’t sell their home then the contingency gives them a way out with a refund of their earnest money. From a seller’s perspective the home sale contingency will lock up the home and if the sale falls through they have lost marketing time on the MLS.

My recommendation for sellers is to always include a “kick out clause” or a “right to continue to market the home.” This allows the seller to continue to market the house for other potential buyers. If a buyer is found and the seller receives an offer the kick out clause will typically require that the seller give notice to the buyer with the home sale contingency. If that buyer can’t remove the home sale contingency at that point then the seller is free to accept another offer. To me that is the best way to respond to a home sale contingency. It allows both parties a fair shot at achieving their goals.

Financing Contingency

Financing contingencies are extremely common. While cash offers exist and would make a financing contingency irrelevant, the majority of offers will include some kind of financing. These days any offer should be presented with a letter from a bank or loan officer stating that the buyer is qualified for the house, but that’s only the first step. Formal application and a long process of underwriting still await the buyer. It’s always possible that during the underwriting possible something could come up. Undisclosed alimony, debts, or other credit related issues could surface in the process which could cause the deal to fall through. The financing contingency gives that buyer a way to get out of the contract and get their earnest money back.

It’s extremely important that as a buyer you get preapproved from a reputable lender to put as few question marks in the process as possible. Likewise a seller should never accept an offer without a letter from a lender. Financing contingencies are very common and not something to be afraid of but you do need to understand the process and the possibilities.

Home Inspection Contingency

The home inspection contingency is one I dread as a listing agent. This is where things go wrong the most! Houses in a state of neglect are one thing but if a house appears to be in great shape it could have an underlying issue you are unaware of! Radon gas, a foundation problem, or a roof issue could bring the deal that was sailing along to a screeching halt.

Like the other contingencies listed here a home inspection contingency gives the buyer a way out of a contract after a home inspection is performed. The buyer will hire a home inspector or other licensed inspectors to examine the home and provide a report of all the issues they can see. Keep in mind these inspectors are not perfect and they probably will miss something which is why they tend to over document even the most minor of issues. Buyers will receive a report that has anything from minor caulking problems to recommendations to seek other professionals for diagnosis. Most home inspection issues can be resolved but depending on what they are it could be expensive.

A typical home inspection contingency will include a time period to do inspections and a second time period for negotiating the repairs. If the repairs cannot be negotiated the buyer then can then opt to terminate the contract or proceed with the sale of the home and accept the house.

I have a post coming soon on home inspections that goes in more detail on the home inspection contingencies.

Appraisal Contingency

If you are using a lender for financing then you will have an appraisal contingency. The bank or institution loaning you the money will want to make sure the property you are purchasing is worth what you are paying. This is for the bank not the buyer. Sure the buyer will get the results but the lender wants to make sure if the buyer ever defaults on the loan that the bank will be able to make their money back. If a house does not appraise for the contract value then a few things can happen.

- The buyer can renegotiate the price with the seller.

- The buyer can bring more cash money to the table to complete the sale.

- A combination of 1 and 2

- or the buyer can back out of the sale.

Not all appraisals are the same and some like FHA appraisals can stick with the home. FHA appraisals are considered valid for 120 days and can be extended. This means if an FHA appraisal came in low and the current buyer were to back out then another FHA buyer coming in would have the same appraisal value. This makes it tricky for the seller to sell to the second FHA buyer since they would need to lower the price or have the buyer bring more cash. Knowing the type of loan a buyer is coming in with is important for the seller so you can understand what the possibilities are.

A Few Less Common Contingencies

Some less common but not unusual contingencies may include things like spousal approval, or contingency on soil testing, or a contingency based on a government approval of a plat. Spousal approval usually occurs when one spouse is out of state or far away but the buyers want to lock down the house. Soil testing contingencies are usually based on a land only property perking for a certain number of bedrooms. The play approval could be where an individual property owner has to get approval to subdivide their land or a developer is creating a neighborhood.

If you can think of a reason you want out of a contract you can make a contingency for it! Keep in mind though the more complicated you make a contingency the more problems you could have with it being accepted.

With any real estate contingencies you need to be aware of what the process is, what effect it may have on the sale process, and what your options actually are. Contingencies very often will have time periods attached to them and if you fall out of those time periods a consequence will occur. Don’t be afraid of contingencies, just be educated!

The Landing at Greens Mill (Columbia TN off of Greens Mill Rd)

Welcome to The Landing at Greens Mill Rd. This neighborhood is located on the north side of Maury County off of Greens Mill Rd. It has east access to the unincorporated town of Neapolis as well as quick travel to Spring Hill (6 minutes) or…

1000 Peyton Place Columbia, TN 38401 – The Estates at Prince Farms

Welcome to 1000 Peyton Place Columbia, TN! This home greets you as you enter The Estates at Prince Farms. The Estates at Prince Farms, when completed, has 28 total homes all on 1 acre lots. All homes in the development are being constructed by the…

Advice for 1st Time Home Buyers in Tennessee

When buying a home for the first time it’s very easy to get wrapped up in all the excitement of looking at houses. You see the photos online, dream of your new home, and all the things you can do in the place. It’s exciting!…

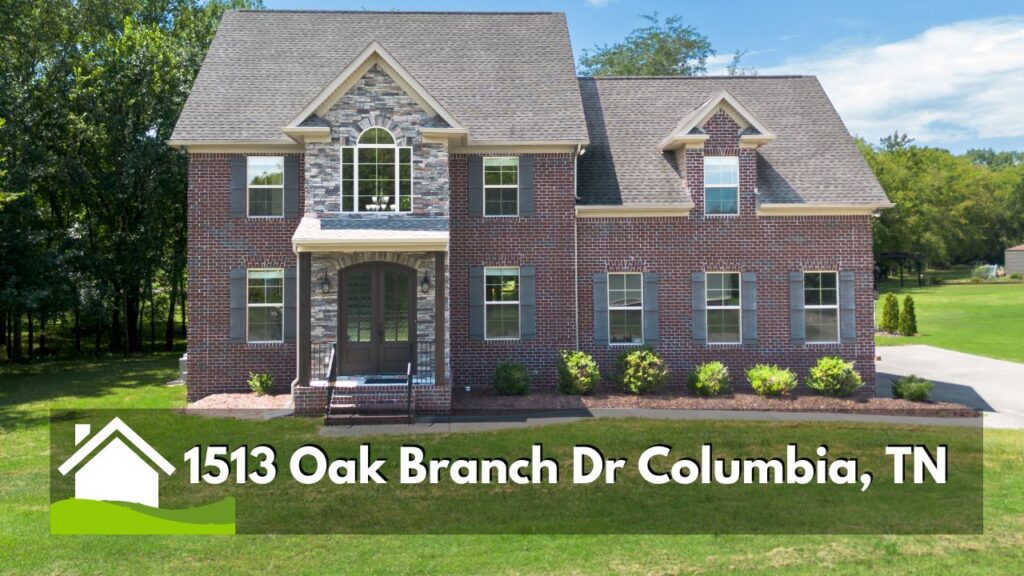

1513 Oak Branch Dr Columbia, TN – Home on an Acre NO HOA!

Are you looking for an ALL Brick home on an acre lot? In a neighborhood without an HOA? A place convenient to Spring Hill, TN and easy access to commuting to Franklin TN? Then check out 1513 Oak Branch Dr in Columbia TN! This location…

5059 Kedron Rd Columbia, TN – Land and Shop for Sale

The sellers removed this property from the market. If you are interested in this property or similar one’s please contact me. What if you could find land in an amazing location, convenient to everything, but not too close to everything? Land that already has the…

Bluebird Hollow – Spring Hill, TN

Bluebird Hollow in Spring Hill, TN is located just off of Main Street through the Autumn Ridge subdivision. You can also get access to this little tucked away neighborhood through Depot St. Bluebird Hollow homes feature Brick and stone exterior with nice interior finishes. Homes…